Fabio Scala: Sérgio, thank you for taking the time to share your views with us. I Understand the IFC today has an outstanding portfolio of US$6.2B as of the third quarter of FY19 in sub-Saharan Africa. Could tell us a bit about the market sectors and the key geographies where you are currently focusing?

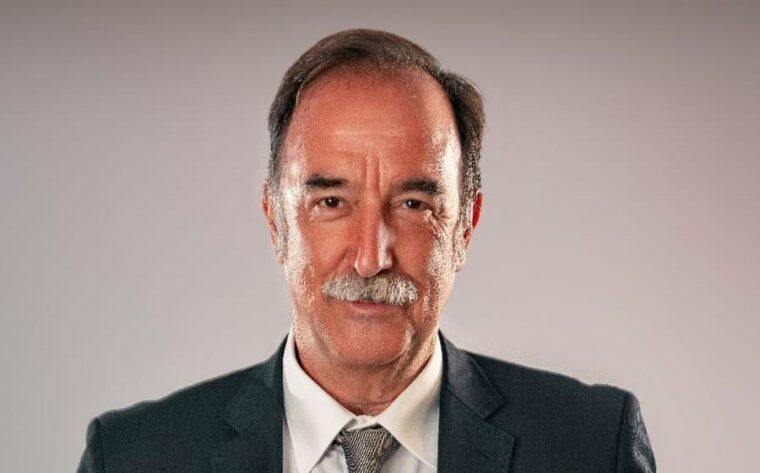

Sérgio Pimenta: Thank you Fabio. It’s a pleasure to discuss the work we are doing in the region.

Africa is a strategic priority at IFC and our portfolio is driving impact across the region, focused on three key pillars – bridging the infrastructure gap, developing a productive real sector and adopting inclusive business approaches.

With Africa in mind, IFC is focused on identifying solutions to the key risks, market failures, and obstacles that prevent the private sector from taking on a greater role in addressing development challenges. This requires a proactive strategy and coordination across the World Bank Group.

IFC is implementing this new strategy – which we call IFC 3.0 – to push ourselves to support investors willing to take more risk in Africa at the country, regional and sector level. The cornerstone of this strategy is to create new markets and new opportunities by mobilizing private capital and tackling regulatory imperfections, to expand financial inclusion, create jobs and bridge the infrastructure gap.

At a practical level, we are designing new models to create markets and that includes linking advisory support with IFC investment, blending concessional funds with private sector participation through the International Development Association Private Sector Window, and utilizing risk-sharing agreements especially in the most fragile and conflict-affected countries.

Fabio Scala: It’s interesting that you are actually involved with the continent’s private sector. The theme of this year’s EurAfrica Forum is a “partnership of equals”, could you elaborate on how you partner with local companies and how that contributes to IFC’s main mission of reducing poverty?

Sérgio Pimenta: We see the tremendous role the private sector can play in addressing some of the world’s most pressing development challenges, including creating jobs and income for people who might otherwise be left out.

IFC supports private sector development in Africa through our investments, upstream advisory work, and our innovative financial tools and products, including the IDA Private Sector Window, blended finance tools and trade finance. As part of our larger Creating Markets strategy, we are helping to mobilize private sector stakeholders to expand financial inclusion, create jobs and bridge the infrastructure gap.

A great example of how we work with private sector partners is the Small Loan Guarantee Program, which supports SMEs in the most difficult markets to access finance. The SLGP facilitates local-currency lending to SMEs in markets where lending is constrained by informality, high collateral requirements, and risk aversion. The program is designed to enhance and strengthen the capacity of financial institutions for risk-taking and financing SMEs and is paired with broader World Bank Group efforts to improve the enabling environment to access finance for SMEs.

These examples show the power of private sector partnerships for development impact.

Fabio Scala: Fantastic. Changing the subject a bit, we recently had a chat with Filipe de Botton about the impact and the synergies of diasporas and how they are increasingly playing an import role in Africa. I understand that you are a member of the Portuguese Diaspora Council since 2018. What has been your role as a Portuguese Diaspora Counselor and what lessons could we take for Africa?

Sérgio Pimenta: Diasporas contribute not only to economic development but also to knowledge sharing and greater world integration. That is why I became a Portuguese Diaspora Counselor in 2018. I believe in the powerful role the diaspora play in facilitating new partnerships and creating development impact.

As IFC, we recognize that to achieve our ambitious business goals in Africa we need to leverage the pool of African talent on the continent and around the world. IFC’s accomplishments in Africa owe a great deal to our regional and global staff that demonstrate on a daily basis IFC’s leading role among multilaterals in promoting private sector development. Our global expertise and talent pool is a competitive advantage for IFC. Diversity is important to us, as is familiarity with our markets and clients.

While IFC’s talent pool is strong, we need to increase our focus on attracting, developing and retaining staff from the region and creating opportunities for them across IFC. This is a personal commitment, and why I put a priority on engaging with the diaspora.

To that end, we need more African staff to accomplish our ambitious future goals in the region. As an employer, we also shape the employment value proposition for talented Sub-Saharan Africans by hiring, growing and deploying staff across our regional offices and globally. Increasingly IFC staff of Sub-Saharan African origin is working in Washington, DC and other regions.

Fabio Scala: Great initiative. Still on the diaspora subject, regarding your participation at the EurAfrican Forum, how do you see the platform’s relevance for change? For transformational action? Why?

Sérgio Pimenta: We face persisting political and economic headwinds that are reducing aid money. Despite progress, development challenges remain immense. Governments cannot address such challenges alone. More than ever, the private sector is a large part of the solution. At IFC, we are determined to make this a reality.

By blending concessional funds with private investment, we are unlocking much needed investment for high-impact projects using new models for development. That’s why it’s important to engage with government and the private sector at platforms such as the EurAfrican Forum, to share the work we are doing, learn from each other and explore new partnerships that can drive development impact.

READ THE FULL INTERVIEW HERE.